Corn sales have been in catch up mode for several weeks but have been cutting the distance significantly. The sales are reported by FAS or Foreign Ag Service of USDA. However, sales are only the first leg to get over the fence to reach USDA’s export projection. Can the US corn market get the other leg, actual shipments reported by FGIS or Federal Grain Inspection Service, over the fence or will it get caught straddling the fence? This was written prior to this week’s data due to a delay by USDA in releasing the report.

The past 5 weeks of sales have averaged just under 76 million bushels in sales with last weeks 98.62 million bushels creating the highwater mark for the 2017-18 market year. This was over 4 times the number of bushels needing to be sold weekly from here on out to reach USDA’s export number on the World Agricultural Supply and Demand Estimates or WASDE. Every week that sales come in above the weekly necessary amount the following week’s amount needed gets smaller. It’s pretty straightforward. Last year sales were pretty strong from March 16th onward and averaged 17.3 million bushels per week versus approximately the 21.1 million needed weekly this year.

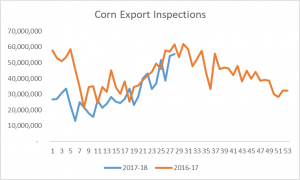

Shipments is where I think things could get really interesting. On Monday FGIS reported that cumulative bushels shipped reached 855.6 million bushels (38.4% of 2017-18 projection) and the past weeks shipments at 55.48 million bushels. This compares to needing to ship 57 million bushels a week, every week, until August 31st to reach USDA’s sharply higher export estimate in the March edition of WASDE. Since shipments fell below the necessary figure it has now moved up to 57.06 million bushels per week. Last year export shipments were strong following sales. Shipments averaged approximately 44 million bushels from March 16th onward. So, the question is this: “Can second half 2017-18 corn shipments outpace the second half of 2016-2017 by nearly 30 percent? At this point, who knows, but it won’t be easy. Beans are in a similar situation albeit maybe a direr one. One thing is for sure, we’ll continue to monitor export shipments very closely because it the second and, in my opinion, the most important shoe to drop when it comes to export activity.