Lakefront aims to help educate investors on managed futures and the benefits of investing in managed futures. We provide managed futures services and resources for both CTAs and managed futures customers.

Managed Futures investments are a type of alternative investment that allow everyday investors to invest in the futures and options markets.

Investing in managed futures is similar to investing in a mutual fund that strictly invests in only the futures market, however, unlike a mutual fund, a managed futures investment is not exchange traded (while it still trades exchange traded futures markets).

Instead, managed futures investments are managed by professional investment management companies known as Commodity Trading Advisors (CTA), who specialize in commodity futures and options trading.Managed Futures investments, are also known as managed futures programs, CTA programs, or Managed Futures accounts. Generally, Managed Futures investments are managed on an individual basis for each individual client, and it is up to the client to choose which program(s) they would like to invest in/add to their existing investment portfolio.

Why Managed Futures?

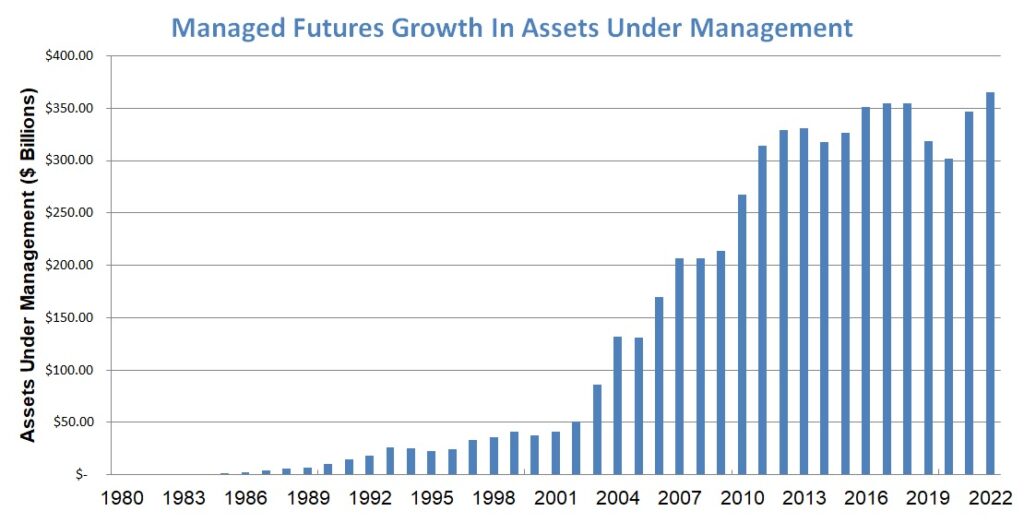

Managed Futures may be a new term for many individuals, including yourself, but the fact of the matter is that Managed Futures have been used successfully by investment management professionals for over 30 years. Their popularity has skyrocketed over the last decade, as more and more individuals look toward something else besides traditional assets, such as, stocks, bonds, and real estate. Assets under management for the managed futures industry has grown from approximately $40 billion in 2000 to close to $250 billion in 2010.

While Managed Futures programs do require a substantial investment, they do not require the millions of dollars that many people mistakenly believe. So why aren’t more people investing in Managed Futures? The answer is simple – because not everyone knows about this investment and its benefits!

How do Managed Futures Work?

Reading your first few items of literature on Managed Futures can make it a little confusing to understand what it is that you are dealing with. First, it is important to understand what Managed Futures is NOT. It is not a stock of a commodity driven company, it is also not a mutual fund of various commodities that are expected to rise, and lastly it is not an ETF (exchange traded fund).

So what is it exactly? When you invest in a Managed Futures investment, you are basically selecting a (or a group of) professional money managers (CTA’s) to manage your assets on a discretionary basis. Most of these CTA’s manage client assets based on a trading methodology or investment approach that they have developed in which they use the global futures market as their investment medium.

Key Benefits of Managed Futures

By their very nature, managed futures offer a diversified investment opportunity. CTAs can participate in more than 150 global markets, from grains and gold to currencies and stock indices. Furthermore, Managed Futures offer many other benefits within a well balanced portfolio:

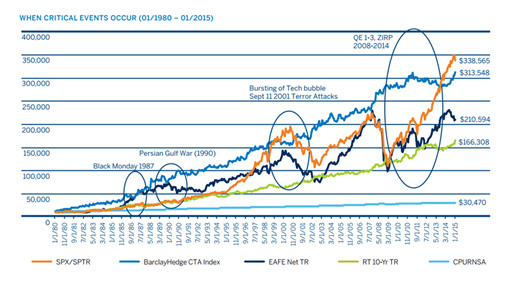

1. Potential to lower overall portfolio risk – by adding managed futures to a balanced portfolio, you have the potential to lower overall volatility. This is possible due to the wide-range of global futures markets that have virtually no long-term correlation to most traditional asset classes. Which means that managed futures investments can profit regardless of stocks going up or down.

2. Opportunity to enhance overall portfolio returns – while managed futures can decrease portfolio risk, they can also simultaneously enhance overall portfolio performance. Adding managed futures to a traditional portfolio may help overall investment quality while also potentially reducing risk.

3. Potential for profit during all economic environments – managed futures trading advisors can generate profit in both rising or falling markets due to their ability to go long (buy) futures positions in anticipation of rising markets or go short (sell) futures positions in anticipation of falling markets. This ability, coupled with their virtual non-correlation with most traditional asset classes, have resulted in managed futures funds performing well relative to traditional asset classes during adverse conditions for stocks and bonds.

4. Broad diversification opportunities – managed futures are highly flexible financial instruments traded on many regulated financial and commodity markets around the world. The various sectors include, currencies, metals, energies, commodities, and interest rates.

4. Broad diversification opportunities – managed futures are highly flexible financial instruments traded on many regulated financial and commodity markets around the world. The various sectors include, currencies, metals, energies, commodities, and interest rates.

5. Security, Transparency and Liquidity – the futures markets are the most heavily regulated markets in the world, regulated by the government run Commodity Futures Trading Commission and the National Futures Association. The sole purpose of the CFTC is to prohibit fraudulent conduct, and abusive practices, while the NFA helps develop rules, programs, and services that help safeguard market integrity. With such stringent regulations in place, all CTAs have to allow maximum transparency to all their investors, which includes, access to account statements, details of all positions, and daily account monitoring capability. Moreover, managed futures accounts are generally liquid with the ability to close accounts or transfer from one CTA to another in a matter of days.

As with any other investment, managed futures, while offering benefits, have the potential for losses. Managed futures have the potential for a substantial risk of loss, and may not be suitable for all investors. Please consult a Lakefront Futures advisor prior to making any investments.

The Concept of “Notional Funding”

Notional funding gives the investor the ability to leverage their managed futures account. Notional funding in Managed Futures is favored by investors because it capitalizes on the free cost of leverage. The leverage is free because the notionally funded amount is not borrowed or deposited – the funding level is a good faith deposit for the full value of the account.

For example, if you wanted to invest with a CTA that had a minimum investment of $100,000, you could either fully fund the account with a $100,000 or, if notional funding was offered, you could partially fund your account – say, with only $50,000 – but still have it traded as if it was funded with a $100,000. The trading level in this case would be $100,000 with the account funded 50%. If the CTA returned 10% that year, you would have made $10,000 (a 10 % gain on the trading level), but it would be a 20% gain on the notional funding level. While it sounds great in theory, the same is true on the downside. Therefore, using the same example above, if the CTA lost 10% that year, it would be a $10,000 loss, but it would equal a 20% loss on your notionally funded amount.

While many investors may like notional funding (due to the reasoning provided above) other investors are wary of the opportunity because of the increased volatility that it brings. By notionally funding an account with 50% of the funds, all returns and losses present in a performance track record of the CTA, are doubled on a cash basis. Therefore, if an investor cannot handle that much volatility, then notional funding is not right for them.

Understanding Fee Structure

Management and Incentive Fees

When investing in Managed Futures, the investor should be concerned with two major fees associated with managed accounts. The first fee is referred to as a management fee, which usually ranges from anywhere on the low end of 0% to a high of 3% (annually). The type of program and the experience of the CTA will help determine the percentage (0%-3%) the investor must pay annually to be in the program. Generally, a prorated portion of the management fee is deducted from the investor’s account on a monthly basis.

The second fee that investors should be aware of is the performance fee or more commonly known as the incentive fee. Prior to the CTA accepting a new account they will negotiate a certain percent of profits that they will keep, giving the CTA an incentive to make the investor money. As the investor makes more and more money so does the CTA. This incentive fee will normally range anywhere from 20% to 30% depending on each CTA. This helps ensure that the CTA will look out for the best interest for your account, because the CTA knows they only make money when the investor is profitable. The incentive fee is a CTAs main source of income.

High Watermark

When a CTA or money manager applies a high water mark to an investor’s money, it means that the manager will only receive performance or incentive fees on that particular account of invested money, when its value is greater than its previous greatest value. Should the investment drop in value then the CTA or money manager must bring it back above the previous greatest value before they can receive incentive fees again. In short, CTAs only receive incentive fees on net new profits.

What is a Disclosure Document?

Investors interested in a managed futures program must review and sign off on the commodity trading advisor’s disclosure document. The disclosure document, or D-Doc as it is commonly referred to, outlines all of the risk factors inherent in managed futures and specifically in the commodity trading advisor’s program. The D-Doc also includes an agreement whereby the client authorizes the CTA to direct trading in the client’s commodity account, and it summarizes any and all management and incentive fees to be charged to your account by the CTA.

Managed Futures Tax Advantages

All gains earned from managed futures accounts are taxed as if they were made up of 60% long term capital gains and 40% short term capital gains. Therefore, 60% of the gains are considered long term capital gains are subject to a maximum federal income tax of only 15%, compared to the short term capital gains which are subject to a top tax rate of 35%. Unlike many other investments, such as stocks, which need to be held for at least 12 months before they gain the coveted long-term capital gain rights, managed futures investments do not have to be held for a specified period of time in order for the “60-40” rule to apply.